The events of the pandemic strongly influence today’s US labor market. The Fed estimates that the pandemic permanently closed an additional 200,000 businesses in 2021 alone, on top of the usual 600,000. The closure of businesses results in permanent job destruction and can detach workers from the labor market, affecting employment recovery.

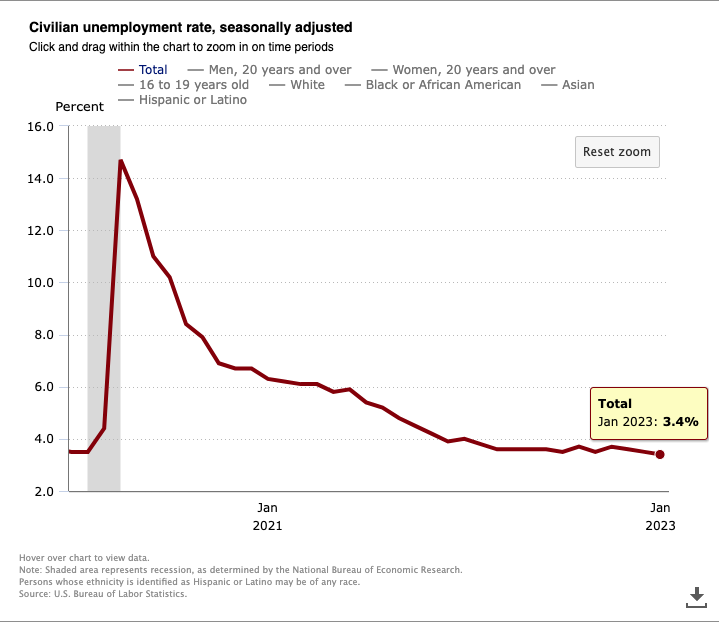

Unemployment spiked dramatically at the beginning of 2020, slowly recovering throughout the year – but not by much. By the end of 2020, unemployment was 6.7% and 10.8 million people, amounting to 4.9 million more unemployed than at the end of 2019.

Then, the job market began to recover. In 2022 alone, employers added a staggering 4.5 million jobs, with a 3.5% unemployment rate in December 2022. So while employers are eager to hire into 2023, available talent is minimal, creating a market where supply isn’t meeting demand.

An Overview of It All: US Labor Market Trends

Here’s an overview of all important data pertaining to the US labor market.

Employment Data

Let’s recap some of the employment data as of January 2023:

- Unemployment rate: 3.4%, the lowest it’s been in 54 years.

- Leisure and hospitality: + 128,000 jobs

- Health care: + 58,000 jobs

- Construction: +25,000 jobs

- Professional and business services: + 82,000 jobs

- Transportation/warehousing: + 23,000 jobs

- Manufacturing: + 19,000 jobs

- Social assistance: + 21,000 jobs

- Labor force participation rate: 62.4%

- Employment-population ratio: 60.2%

January 2020 – January 2023

January 2020 – January 2023

Hiring Trends

As of January 2023:

- Job openings: 10.8 million

- Job openings rate: 6.5%

- Hires: 6.4 million

- Hiring rate: 4.1%

- Separations (quits, layoffs, discharges, etc.): 5.9 million

- Separation rate: 3.8%

Overall, these trends were relatively unchanged since the last update.

Wage Growth

As of January 2023:

- Average hourly earnings: + 10 cents to $33.03 | 4.4%

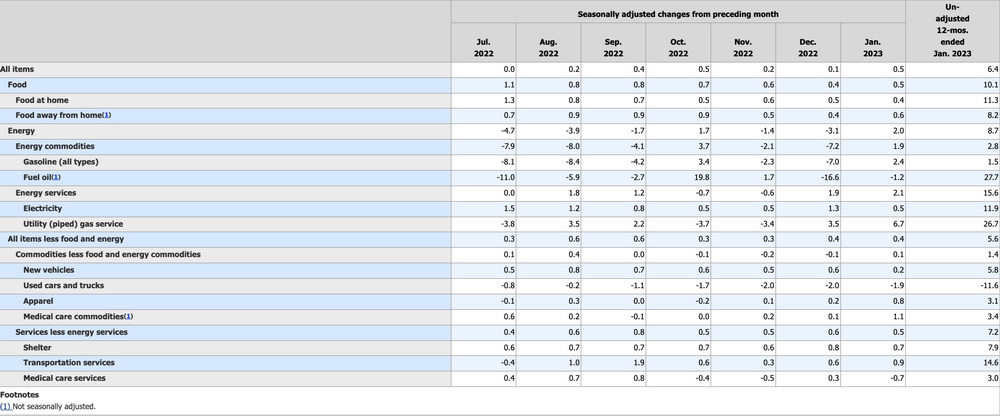

- CPI: + 0.5% as of January 2023

CPI

A Note on The Tech Sector

Despite a broader labor shortage, the increasing economic pressures of cutting costs amidst rising inflation caused a slew of layoffs and hiring freezes in the tech sector.

Since the start of 2023, more than 125,000 employees in the tech sector lost their jobs. There have been – and continue to be – notable tech layoffs from giants like Google, Meta, Microsoft, Palantir, and more.

Why are these layoffs so persistent in tech and in the US labor market?

Firstly, many companies massively overhired during the pandemic when it was easy to do so. As profit margins become harder to preserve, maintaining such a large workforce is a luxury some companies can’t afford.

Further, when a company’s tech giant peers start laying people off and seeing stock increases, their investors pressure them to do the same, even if it isn’t strictly necessary.

All of this presents a unique situation for the tech market. Many employees feel extreme uncertainty and are motivated to keep their jobs, and employers are motivated to fill talent gaps internally.

Current Labor Force Participation Rate

Despite today’s incredibly low 3.4% unemployment rate, the labor force participation rate remains almost unchanged from 2020 until today’s US labor market. At the start of the pandemic in February 2020, the labor force participation rate was 63.3%; as of January 2023, that rate was 62.4%.

These labor force participation rates tell a clear story: capable employees are being overlooked or are sitting out.

Why The Continued Labor Shortage?

There’s a persistent labor shortage unchanged since the start of the pandemic. Here are some reasons why that could be the case.

More Savings

Since early 2020, Americans added around $4 trillion to their savings accounts. This increase is primarily due to stimulus checks, unemployment benefits, and the inability to go out – travel, dining, clubs, etc. – and spend money.

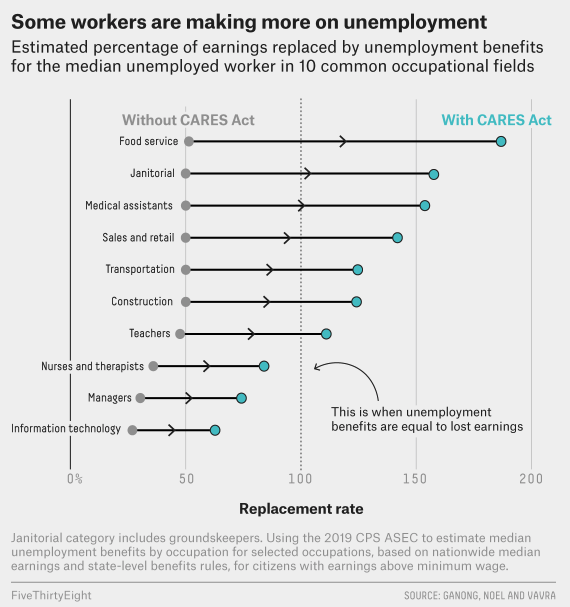

The enhanced unemployment benefits, which stopped in September 2021, caused 68% of claimants to earn more on unemployment than while working. The estimated median replacement rate, which calculates the percentage of an employee’s weekly salary being replaced by unemployment, was 134%, meaning the average person on unemployment was earning a third more than they did working.

Although we may be well past the CARES Act, the impact of increased savings persists and dampens the need for work in today’s labor market.

Lack of Accessible Childcare

The childcare industry lost over 370,000 jobs between February and April 2020. Workers returning to work in the current US labor market need reliable childcare, but finding it is now much more challenging.

Women’s labor force participation rate is at its lowest since the 1970s, and perhaps the lack of accessible childcare is why. Another reason may be the bolstering in Americans’ savings – this made it so that a single-employment household is sufficient in more cases.

Early Retirements

As of October 2021, Covid caused 3 million early retirements in the US. More than 25% of workers state that the pandemic caused them to move up their retirement. Unfortunately, many of these workers aren’t in a financially stable position to retire, with this percentage only increasing by 5 percent from 50 to 55%.

67% of retirees on Social Security receive less than the average $1,503 monthly benefit because they claimed benefits before the retirement age (67 if born after 1960).

Although many didn’t want to retire, the pandemic forced millions of early retirements and is likely to cause more over the next few years. This will continue to have a significant impact on the US labor market in the years to come.

2023 Job Market Predictions

What does 2023 hold for the job market?

Upskilling and Quiet Hiring

With America’s labor shortage persisting into 2023, employers will look internally to fill talent gaps. This presents a unique opportunity for employees, especially those eager to keep their jobs amidst layoffs.

As an employee, this means being open to quiet hiring. Your role may not fundamentally change, but employers might ask you to take on adjacent tasks to help fill talent gaps. Upskilling allows you to further your career at a company you’re already familiar with.

Upskilling and quiet hiring require communication on both ends to succeed. Employers need to be open to salary negotiations as employees take on tasks outside their original scope, and employees need to be flexible with the work on their plate.

Regular feedback and discussions between employers and employees will help make this process seamless.

Importantly, employers investing in the long-term success of their employees through upskilling give themselves a competitive edge in today’s tough labor market. Top candidates will see prioritizing employee development as a positive.

Flexible Working Arrangements

While the worst of Covid seems to be behind us, its effect on the work week persists. Companies are getting as much – or more – done, even with remote workers.

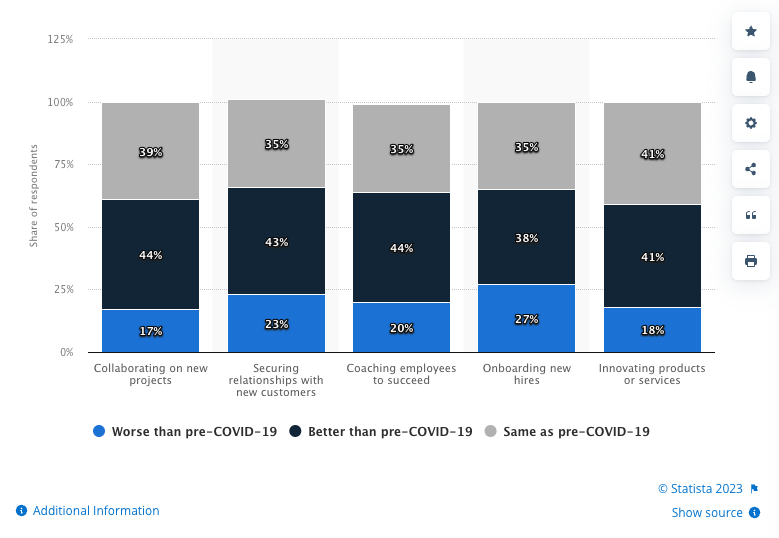

Compared to pre-Covid and utilizing a hybrid workforce, 44% of companies feel more efficient at collaborating on new projects, with 39% noting no change. 41% of employers think they’re better at innovation post-Covid, with 41% citing no change.

Take a look at the graph below for more data.

Graph: How would you describe how effective your company has been at performing the following activities with employees working remotely?

The viability of remote and hybrid work depends on the type of organization, with some having an easier time than others. But if it’s an option for your organization, you’ll want to try it.

Offering flexible working arrangements makes companies significantly more appealing to candidates and diversifies their talent pools amidst today’s tough US labor market.

More Competitive Landscape

Until around mid-2022, it was often enough for candidates to blast generic resumes to employers and get a call back. Companies were hiring rapidly with less regard for candidate quality.

In the US labor market today, although supply isn’t meeting demand, uncertainty about economic futures makes employers more cautious about whom they hire. The market is strong but competitive, and candidates need to focus on professional branding, networking, and resumé optimization to stand out.

Retention Matters

Employees are feeling the pressure of the current US labor market, with calls for a recession looming. However accurate (or not) those predictions are, if employees are unsatisfied at work, now’s the time they’re going to try and make a change. It’s risky to wait.

Employers can’t afford to lose talent right now, so there needs to be careful attention to employee retention.

Here are some effective strategies for lowering turnover:

- Hiring for culture fit

- Developing employee engagement

- Offering flexible work

- Building top-tier onboarding processes

- Recognizing excellent work

Learn more about employee retention strategies.

Need Help Hiring?

The current US labor market makes it particularly difficult to find qualified candidates. Especially when it comes to senior- and executive-level roles where the cost of a bad hire is staggering, consider outsourcing your hiring to an executive search firm.

Jennings Executive has over two decades of combined experience sourcing leading talent for companies. A competitive hiring landscape is where we thrive. We’d love to help you fill open positions – contact us to learn more!