How heightened M&A activity, qualified labor shortages and new firm incentives have created the perfect storm for candidates to command higher salaries and earlier promotions.

In this crazy new normal we now live in, stocks and real estate aren’t the only fields that have seemingly experienced an inexplicable rise to all-time highs of late.

Consultant salaries, among others, have seen a ~10%+ increase in total compensation on average over the last 12 to 18 months, driven by a multitude of factors that we will explore throughout this article.

Naturally, the degree of compensation increase varies by seniority level, and although the recent run up in consultant salaries and bonuses have favored both senior and junior roles alike, candidates with less than 6 years of total experience have seen the largest relative increase in decades (hint: if you’re unhappy in your current role, or not sure you’ll make partner, or simply want a pay raise, now is the time to kick off your search!).

The driving force behind rising compensation levels boils down to the supply/demand dynamics for qualified labor – simply put, there’s currently a drastic shortage of skilled candidates. This has been further amplified by the incessant M&A market, which has been on fire since it “emerged from quarantine” back around December 2020 (more on this below).

In this article, we’ll explore the reasons behind the run up in salaries by taking a deeper dive into the M&A market and where we think it’s heading, including how much consultant salaries have increased (by education level and seniority). We’ll also provide candidates and employers with updated salary expectations based on Jennings Executive’s proprietary data and most importantly, explore how candidates can leverage the current market environment to command higher salaries earlier on in their careers.

Part I – The Post-Pandemic M&A Era is Driving an Unprecedented Demand for Consultants

The global pandemic has had a considerable impact on global M&A as corporations and institutions across the country have and are expected to continue to adapt to these ever changing markets.

Looking back to the beginning of 2020, the COVID-19 pandemic overwhelmed the global economy & governments and, as a result of the ongoing uncertainty and lockdowns, M&A was brought to a near standstill in the first half of 2020.

This trend didn’t last long, as the market began to show signs of recovery sooner than most might have expected. In H2 of 2020, a combination of pent-up growth demand (or need for some) and the imminent need to digitize started an M&A frenzy, with Q4 2020 taking the crown as the highest-value quarter ever for US M&A.

We’ve observed that the primary driver of deal-making in 2021 continues to focus on a recalibration strategy and accelerating the adoption of technology in the wake of COVID-19. PwC’s Annual Global CEO Survey suggests that the majority of business leaders are confident in a continued strong economic environment on the back of solid macroeconomic indicators such as positive GDP growth and high consumer price index rates.

Despite inflation concerns and geopolitical factors such as tax policy, protectionism, and increased regulatory scrutiny, the survey shows CEOs appear to have a clear impression of where future value creation opportunities exist. This vision is predicated on an acute focus on M&A strategies to accelerate growth, gain scale & grab market share, and most importantly, adapt business models to the new digital-first reality.

Throughout the first 9 months of 2021, cheap interest rates, pent up M&A demand from 2020, distressed opportunities and plenty of capital available has fueled record M&A activity (similar to the end of 2020 discussed above). This abundance of capital is leading to purchasing / bidding wars between corporates, private equity funds and SPAC’s for companies.

A recent Reuters report noted that the total value of pending & completed deals announced in 2021 has already surpassed $3.6 trillion year-to-date, leapfrogging over the full-year tally of $3.59 trillion in 2020. To date, a total of 35,128 deals have been announced in 2021, a 24% increase over last year.

Part II – A shortage of Qualified Labor Is Putting Upward Pressure on Salaries & Compensation

So M&A activity has significantly ramped up, but how does this tie into salaries and hiring?

Given 2020 was no ordinary work year, the disruption of businesses across the country led to an expected disruption in consultant salaries. At first, the pandemic seemed to bring on a hiring freeze and the industry feared massive layoffs. Fast forward a few months and the rebound in the economy has significantly changed the landscape.

The plethora of companies looking to grow inorganically is creating the need for more specialized professionals; on one hand you have a diverse range of companies in various industries competing for talent. On the other hand, there aren’t enough humans to fill the roles. There’s simply too much M&A activity going on right now for the current labor supply.

The continued rally in M&A activity has led to unprecedented labor shortages, with the need for specialized consultants such as pricing consultants, strategy consultants, IT consultants and M&A advisory consultants (to name a few) in extremely high demand.

Essentially, any sort of consultant that is involved in the M&A process, whether it be a transactional role or a post-merger integration role, has benefited from this market cycle in two ways:

- These jobs are more in demand than they’ve ever been (shifting the balance of negotiating power)

- The work-from-home era has led to increased hiring bonuses, ongoing daily work perks and retention incentives.

This healthy competition for talent, coupled with potentially higher capital gains tax and other potential reforms from the Biden administration, has led us to the point we’re at today, which is a short-to-medium term window of surging M&A, consulting, and other professional service demand.

More specifically, professionals in the valuation, operational, financial & tax due diligence spaces are highly sought after.

Lastly, the M&A craze is being led by well capitalized firms, meaning they have the ability to shell out more capital on consultant salaries and total compensation (think higher salaries, one-time incentives, etc.).

The overall US job market is experiencing a “post” pandemic hiring boom. There are currently more job openings now than at any other time in recorded US history, and American workers are rushing to take advantage of pandemic bargaining power.

The candidate’s bargaining power, defined as the ability of an employee to command higher wages and benefits and demand certain terms, has been on the rise. Although there’s no scientific measure for this phenomenon, we work very closely with our candidates during their placement periods and observed a meaningfully higher degree of negotiation leverage.

Leading into the pandemic, the labor force was already starting to favor workers. “We had a tightening labor market before the crisis, and the war for talent was already picking up,” said Diane Swonk, chief economist at advisory firm Grant Thorton. “By both constraining supply and boosting demand, we have put the whole labor market on steroids. While wage growth has benefited all workers, higher-skilled workers with technical skills that can be used remotely have gained more autonomy and market power and widened the geographic range of potential employers.”

Part III – Consulting firms & Industry Alike are Aggressively trying to attract and retain their top talent

Consulting firms are looking to differentiate themselves and their hiring practices by using non-traditional compensation packages as a recruiting tool. Here are a few examples of what some well-known firms have recently implemented:

· L.E.K. upped its profit-sharing plan to incentive employees to stay

· EY announced unlimited Paid Time off in certain geographies

· Some practices at KPMG are limiting travel to 25% in an effort to improve work-life balance for employees (whereas the typical consultant travels 80%+ of the time), even post return to office

· Deloitte has begun paying large signing bonuses to incentivize candidates to choose the firm

Not surprisingly, the traditional financial players are continuously in the mix and looking for more and more consulting talent. As investment banks compete for talent and implement large consultant salary increases, the Big Four in particular have been losing talent to higher paying banking rivals. The advisory, consulting, and transaction services teams have all been hit equally.

On the other hand, you have large tech companies such as Google, Netflix, Amazon and Facebook (keeping in mind that these businesses have thrived over the last 2 years) which continued hiring unabated and are driving up the average compensation expectation. Top talent is being pulled in all directions!

If the M&A craze and labor shortage wasn’t enough, we’re also seeing a number of management consultants burning out and quitting their jobs due to long hours working from home. Management consulting firms (in particular the Big 3) are responding with bonuses, perks, and pay raises. Offering incentives to encourage people to take vacation time, make up for lost travel perks, and hand staff some extra money have become the norm at a lot of consulting firms.

To poach talent, some firms have added signing bonuses, extra vacation days, healthcare benefits, special programs for mental health and home office perks.

The 2 primary tools firms are using to lure in new talent and retain their existing salaries are:

a. Salary increases. Junior roles have seemingly benefitted more than senior roles, but overall, consultant salaries have been trending upwards as previously discussed. Historically, a consultant transitioning into an industry role would expect a haircut to his/her overall compensation. Having helped a number of candidates transition from consulting roles to industry roles, we’ve noted that most of these offers have been at par (and in some cases, a significant increase) with the candidate’s previous compensation. In response, the larger consulting firms have been implementing salary hikes and have been utilizing counter offers more frequently as a means to retain talent (counter offers have always been around, but we’ve never seen them being used at this scale). BCG’s recent $10K pay bump for associates is just one of many examples of this phenomenon currently unraveling in the market. We’ve also observed that a Big 4 auditor with a mere 2-3 years of experience commands $10K-$20K more than a year or two ago.

2. New Benefits & Incentives (including retention bonuses).

a. BCG gave its consultants 180,000 Marriot points to make up for missing out on travel rewards. (source)

b. PwC introduced a program that offers employees $250 each time they take a full week of vacation time, up to four times or $1,000. PwC also gave all of its US staff one week of extra pay as a special bonus on top of its existing bonus structure. (source)

c. KPMG implemented multiple perks such as undisclosed mid-year compensation adjustments, a summer break where the firm will be closed the week of July 5, and “Jumpstart Fridays,” where professionals can log off of work early on Fridays in the summer (source)

The firm also rolled out additional benefits and changes recently to combat burnout and promote healthy workloads, including weekly “heads-down” time for employees to work without meetings and other distractions; eliminating video meetings on Fridays; shortening 30- and 60-minute meetings to 25- and 50 minutes; and pushing everyone’s meeting availabilities back an hour each morning.

d. McKinsey is offering special COVID bonuses amounting to “thousands of dollars” to all non-partner employees to be paid in two installments

In short, the sheer lack of qualified candidates to fill these roles resulted in higher sign on and retention bonuses, as well as relatively large increases in consultant salaries and quicker promotions.

Part IV – 2021 Consultant Salary Expectations

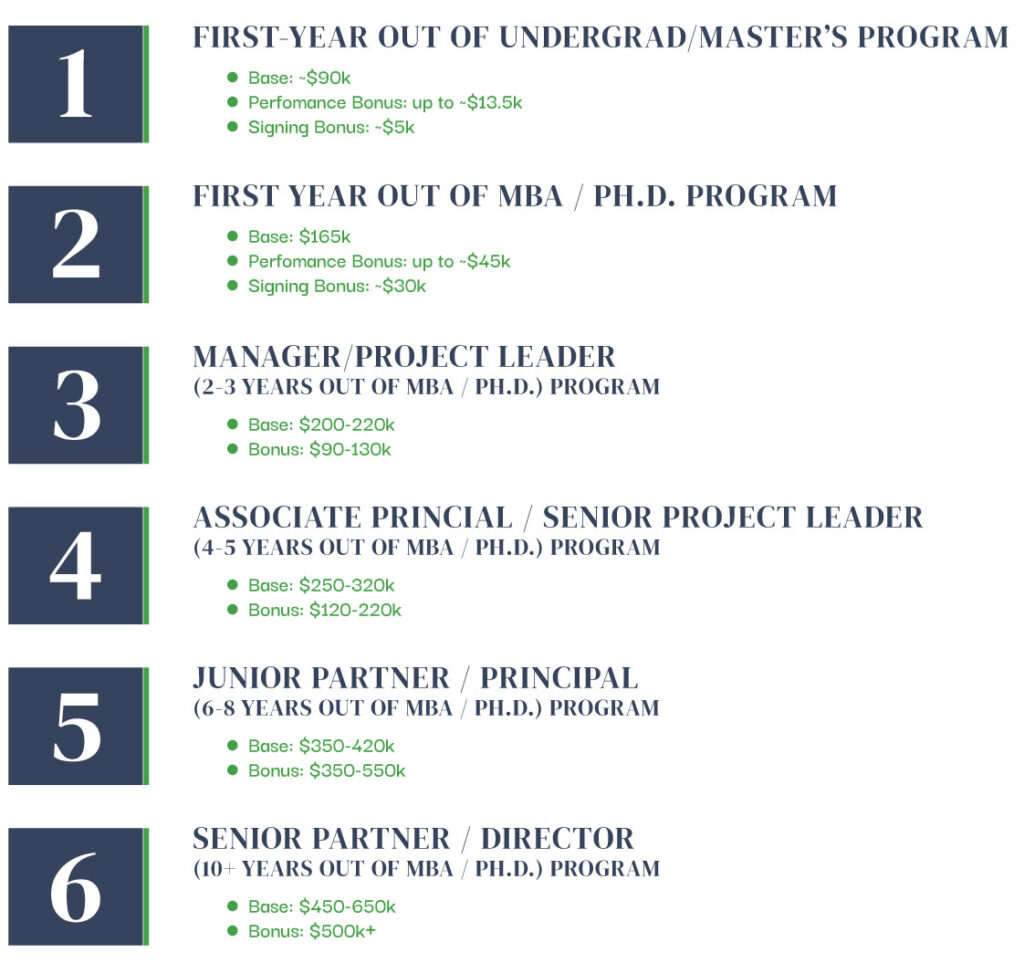

From a consultant’s point of view, the pandemic and M&A induced change did not disappoint. Below is a general consultant salary expectation range by seniority level one can expect in 2021:

The following tables break down the expected all-in compensation by education and seniority and are further broken down by Bain/McKinsey/BCG, Big Four and boutique. Accurate, reliable and updated salary data (updated for the aforementioned trends) is extremely difficult to come across, yet over 80% of job seekers see compensation as one of the primary factors in their employment decisions.

The data was compiled from Jennings’ proprietary knowledge and recent placements and supplemented by ManagementConsulted’s 2021 Salary Survey.

Disclaimer: actual salaries may vary by firm and other circumstances that are tough to capture in a salary range. If you’d like to speak about compensation for a specific role and/or firm, feel free to reach out to our CEO Jon Jennings to set up time to chat ([email protected]).

Salaries for Incoming MBA & PhD Full-Time Hires

Note that the ranges below are standard ranges (i.e. salary ranges for the typical performer)

Bain, BCG, and McKinsey Consulting Salaries

Big Four

Candidates & Job Seekers, Now is the Time to Make a Move

Despite the upheaval in the industry, consultant salaries and career opportunities continue to grow. Both at the undergraduate/master’s and post-MBA/PhD levels, consultant salaries continue to stay competitive to rival Banking and Big Tech.

Overall, record-breaking deal making in the US is encouraging consulting firms to beef up staffing, but the increased demand for consultants is forcing some to pay up in unique ways to attract new hires.

At risk of sounding like a broken record, M&A is really hot right now and nearly all related jobs/fields are benefitting whether it be in the form of higher salaries, lower entry requirements and/or better benefits. There hasn’t been a better time to negotiate a lateral raise or ease into a new role now in the last few years. We encourage you to put some feelers out there now and see what your talents can fetch.

As our founder Jon Jennings put it nicely: “Capitalize on this opportunistic market instead of staying in your role and just getting the inflationary raise. The time to make a big career definition move from a salary and opportunity perspective is now. I’ve personally placed several consultants in pricing and other roles at all-in comps that are unheard of in our industry”.

Feel free to reach out to one of the professionals at Jennings Executive Search if you are considering moving into a new role, whether it be a total career change or a move to a competing firm (for a better compensation package and/or promotion of course). If you’re unsure you’ll make partner (or get a significant pay bump for that matter) at the firm, now is the time to shop around for a new role.

About Jennings Executive Search – Who We Are

Jennings Executive is a nationwide executive search firm based out of Atlanta, Georgia. Our consulting placement practice is led by CEO Jon Jennings, a lifelong executive recruiter with a bachelor’s in accountancy and minor in finance from the University of Mississippi.

The candidates we place typically have consulting, investment banking, private equity general finance, marketing or engineering experience and possess undergraduate and graduate degrees from a wide array of academic institutions.

Jon Jennings, the founder and CEO of Jennings Executive Search, recently discussed his process of matching pricing teams with the right talent with Mark Stiving, the founder of Impact Pricing and U.C. Berkeley PHD, in an insightful 30 minute podcast. You can listen to the podcast here.

If you’re looking to hire your next executive leader, Jennings Executive can help take the guesswork out of recruiting. With two decades of experience, our team knows how to find and place the best leadership talent at your company. For more information, please or visit JenningsExec.com or give us a call at 678-401-8565.